Rome was not built in a day, as the saying goes. The same is valid for tax planning. Tax planning that is timely, consistent, and effective can result in significant savings. Furthermore, it simplifies the annual procedure of filing taxes. 7 Crucial Expenses to Know Before Tax Planning

Tax planning helps individuals save money on taxes and make smarter financial decisions. Before engaging in tax planning, one must understand some 7 Crucial Expenses to Know Before Tax Planning crucial expenses that can impact tax liability. This article will explore some of the most essential costs to be aware of when planning for taxes.

| Table of Contents |

Importance of Tax Planning

As we discuss the importance of tax planning, it is essential to personal finance, and understanding the crucial expenses that can impact one’s tax liability is the first step in optimizing one’s taxes. Individuals can reduce their taxable income and save on taxes by taking advantage of tax-deductible expenses, such as home mortgage interest and charitable contributions. Additionally, individuals can optimize their tax returns by taking advantage of tax-advantaged retirement accounts and seeking professional tax advice. By understanding these crucial expenses and making the most of available deductions and credits, individuals can reduce their tax burdens, save money, and feel more in control of their finances.

Also, read our Article on: An Overall Assessment of Income Tax Notice

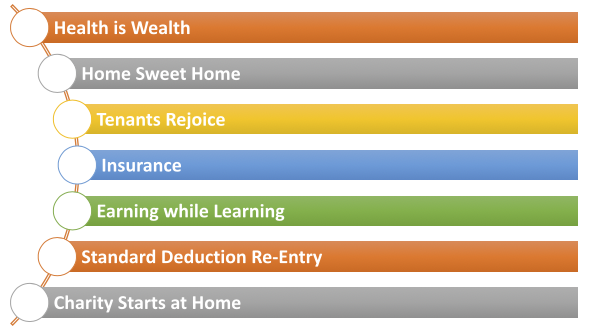

Tax Planning and 7 Crucial Expenses to Know Before

Tax preparation, contrary to common assumption, is not rocket science. It is merely a matter of comprehending income tax legislation and determining where to invest or spend your money. People are sometimes startled to learn that their investments with their hard-earned money qualify them for tax breaks. It is not always possible to be ignorant. So, to get the most out of your money, keep reading.

- Health is Wealth: Effective tax planning saves you money while also keeping you healthy. The premium you pay for your Mediclaim policy may be tax deductible. Health insurance premiums up to Rs. 25,000 can be claimed for income tax exemption under Section 80D of the Income Tax Act. Individuals can pay the premium for themselves, their spouses, parents, and children. In the Assessment Year 2019-20, the maximum for senior citizens is Rs. 50,000.

- Home Sweet Home: Your house loan benefits you in more ways than you realize. It not only helps you finance your dream home, but it also helps you save money on taxes. The Income Tax Act of 1961 permits an individual to deduct the principal loan amount and interest for tax purposes. Section 80C of the Act allows for a deduction of up to Rs. 1.5 lakhs from the principal amount. Section 24 of the IT Act addresses the interest on such house loans. This area allows for a maximum of Rs. 2 lakhs.

Furthermore, a loan acquired for the rebuilding (including repairs) a residential property might be deducted. The highest sum that can be removed for such maintenance is Rs. 30,000. It is part of the Rs. 2 Lakhs restriction for including house loan interest.

- Tenants Rejoice: Each renter sheds a tiny tear when it comes time to pay the landlord’s rent each month. However, you’ll feel better once we discuss the potential tax savings with you. You can claim an income tax deduction if you receive House Rent Allowance (HRA) and your actual wage. Calculated as the least expensive of these three possibilities:

- The existing House Rent Allowance was included in the compensation by the employer.

- Ten percent of the wage is less than the original/actual rent paid.

- 40% of the Salary for individuals living outside of metro areas or 50% for those who do.

- Basic Salary, Dearness Allowance, and Turnover-Linked Commission constitute Salary for this purpose.

- Insurance: The beauty of tax planning is that most tools serve two functions. Life insurance not only protects your dependents’ futures, but it also helps you save money on taxes. It is covered by Section 80C, and the premium paid can be claimed for tax deductions up to Rs 1.5 lakhs.

- Earning while Learning: In today’s world, education necessitates significant financial resources. Many people take out an education loan to pay for their higher education. A school loan, like a home loan, offers two advantages. It aids in tax planning in addition to paying for educational courses. The interest paid on such loans can be claimed as tax-deductible under Section 80E. Some key points to remember are:

- The loan can be used towards the education of oneself, one’s spouse, or one’s child. As a result, the tax break is also available to parents who take out loans for their children.

- This incentive is only available for full-time courses.

- A loan from a financial or charity institution should be obtained. Loans from friends, relatives, or money lenders are not deductible.

In addition, if a person pays for their child’s school tuition, they can claim a tax deduction. Section 80C allows for an exemption up to a total of Rs 1.5 lakhs. This limit includes all Section 80C deductions such as insurance, pension, PF, etc. Some points to consider are:

- The tax deduction is restricted to the amount of tuition paid.

- Each parent can claim a maximum of two dependent children.

- This incentive is only available for full-time courses.

- This regulation applies to all educational establishments, including crèches and playschools.

- This regulation now applies to adopted children as well.

- Standard Deduction Re-Entry: For many years, we have happily claimed conveyance allowance and medical allowance as tax deductions. However, these two deductions have been eliminated due to amendments made to the income tax legislation (effective AY 19-20). Instead of these two expenses, the government has reintroduced the notion of a standard deduction (Rs. 40,000). If you are a pensioner or a non-salaried person, you will gain significantly from this reform.

- Charity Starts at Home: “Neki kar dariya mein daal” means “do good and then forget about it.” However, for tax planning purposes, we advise against it. Maintain an accurate record of all donations made during the year. Section 80G of the IT Act allows you to deduct gifts from specific institutions and charity organizations. Depending on the recipient’s classification, one can deduct 50% or 100% of the donation.

The maximum deduction available under this clause is 10% of the donor’s gross total income.

Also, read our Article on: How to Calculate Capital Gain Tax in India?

Types of Tax Planning

Effective tax planning requires a deep understanding of relevant tax laws and regulations and the ability to evaluate various investment and planning options. At the same time, there are different types of tax planning, including income tax planning, retirement tax planning, estate tax planning, and business tax planning; the most effective strategies depend on an individual’s or business’s unique financial goals and circumstances.

- Individual Income Tax Planning : Identifying and taking advantage of various deductions and credits available under federal and state income tax laws.

- Retirement Tax Planning: Planning for the tax implications of retirement income, including contributions to retirement accounts, withdrawals from retirement accounts, and Social Security benefits.

- Estate Tax Planning: Planning for the transfer of wealth and minimization of estate taxes upon death.

- Business Tax Planning: Identifying and taking advantage of various deductions and credits available under federal and state corporate tax laws to reduce business taxes and maximize profits.

- Tax Loss Harvesting: Selling investments at a loss to offset gains and reduce capital gains taxes.

- Tax Deferred Exchange: Exchanging one investment for another without triggering capital gains taxes.

- Cost Segregation: Accelerating depreciation deductions to lower income taxes.

In addition to these types of tax planning, there are numerous other strategies that individuals and businesses can employ to reduce their tax liability. It’s essential to seek the advice of a qualified tax planner or CPA to determine the most effective tax planning strategies for one’s unique situation.

Also, read our Article on: Income Tax Return Filing without Form 16

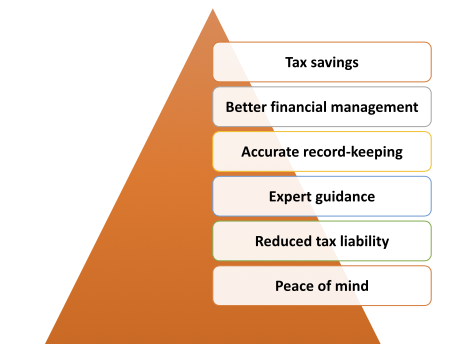

Advantages of Understanding Crucial Expenses Before Tax Planning

The advantages of tax planning are numerous before understanding those crucial expenses. Here are some of the key benefits:

- Tax savings: You can save significant money on taxes by claiming eligible deductions. The more deductions you claim, the lower your taxable income and the lesser the tax you have to pay.

- Better financial management: Understanding your expenses beforehand can help you manage your financial resources better. You can plan your spending, save money on taxes, and invest your savings wisely.

- Accurate record-keeping: Tax planning requires correct records of your expenses for tax purposes. Doing so can ensure you claim the maximum deductions and take advantage of all benefits.

- Expert guidance: Consulting with a tax professional can help you understand the tax implications of your expenses. They can provide specialist advice, help you plan your finances better, and make informed investment decisions.

- Reduced tax liability: By claiming eligible deductions, you can reduce your tax liability and save money. It can help you achieve your financial goals sooner, such as retirement, education, or buying a home.

- Peace of mind: Proper tax planning gives you peace of mind and ensures you comply with tax laws. You can avoid the stress of unexpected tax bills and penalties, which can be costly and stressful.

Thus, understanding the crucial expenses before tax planning is essential for effective tax planning. With the proper guidance and planning, you can save significant money on taxes, manage your finances better, and quickly achieve your financial goals.

Also, read our Article on: How to maximize your tax saving by choosing the right insurance policy for yourself & family?

Things to Keep in Mind While Understanding Crucial Expenses Before Tax Planning

Along with the deductions allowed for repaying a mortgage, one may also claim an HRA exemption. It is relevant in situations where:

- The person lives somewhere other than the city where their home secures a loan.

- The person is renting out the house (for which a debt is owed) while residing in another rental. Including the rental income in the tax computations in this situation is crucial.

- The tenant must submit their rent receipts and the landlord’s PAN information. A statement must be sent to the employer if the landlord does not have a PAN card.

Also, read our Article on: Income Tax Return Filing (ITR Filing in India)

END Note

In conclusion, tax planning is an essential part of financial management. By carefully planning your taxes, you can save significant money and maximize your benefits. Before planning your taxes, it is crucial to know the seven essential expenses before tax planning. These include tuition fees, health insurance premiums, home loan interest, donations to charity, professional fees, home office supplies, and rent and life insurance expenses. Understanding these expenses allows you to claim eligible deductions and reduce tax liability. Additionally, it is essential to keep accurate records of costs and consult with a tax professional to ensure that you are claiming the maximum deductions. Proper tax planning lets you make the most of your hard-earned money and quickly achieve your financial goals.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (90)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (200)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (21)

- Startup/ Registration (128)

- Trademark Registration/IPR (40)

Recent Posts

- Post incorporation compliances for companies in India April 30, 2024

- Startup’s Guide to Employee Stock Ownership Plans April 29, 2024

- Master Secretarial Audit: A Complete Compliance Guide April 27, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.