What Is Non-Resident External (NRE) Account for Indian Seafarers?

- November 8, 2021

- Income Tax

A Non-Resident External (NRE) account is a bank account for NRIs which are INR-dominated to transfer their foreign currency to India. Foreign exchange earnings can be credited to NRE accounts and maintained in Indian Rupees. This article discusses all the benefits, types, features and much more about Non-Resident External (NRE) account for Indian seafarers

| Table of Contents- |

What is Non-Resident External (NRE)?

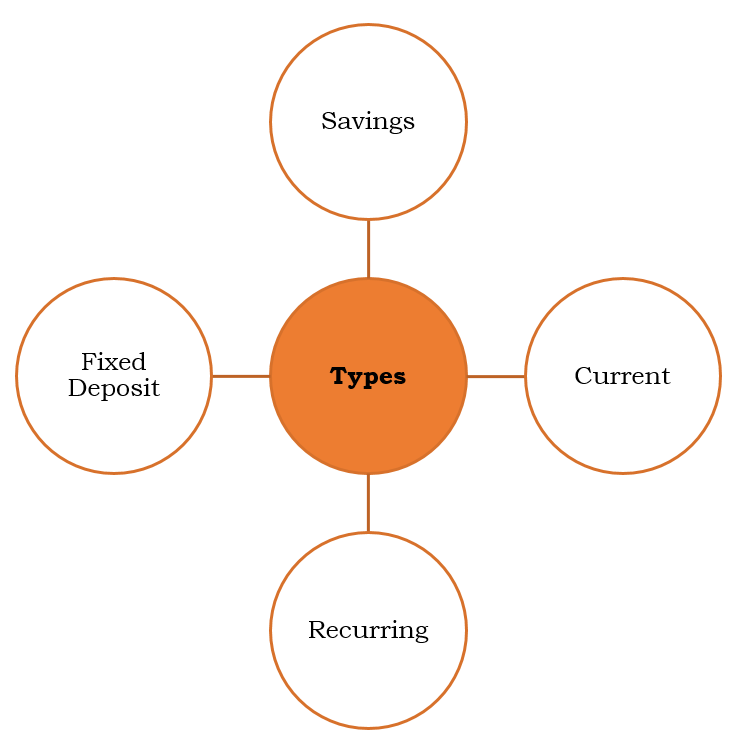

NRE is a bank account to transfer foreign currency to India. It can be a savings account, a current account, a recurring deposit, and a fixed deposit account. These accounts can be opened individually or collectively. However, if one wishes to open a joint account, it is only possible with another NRI. In addition, the amount of interest earned on this account is completely tax-free.

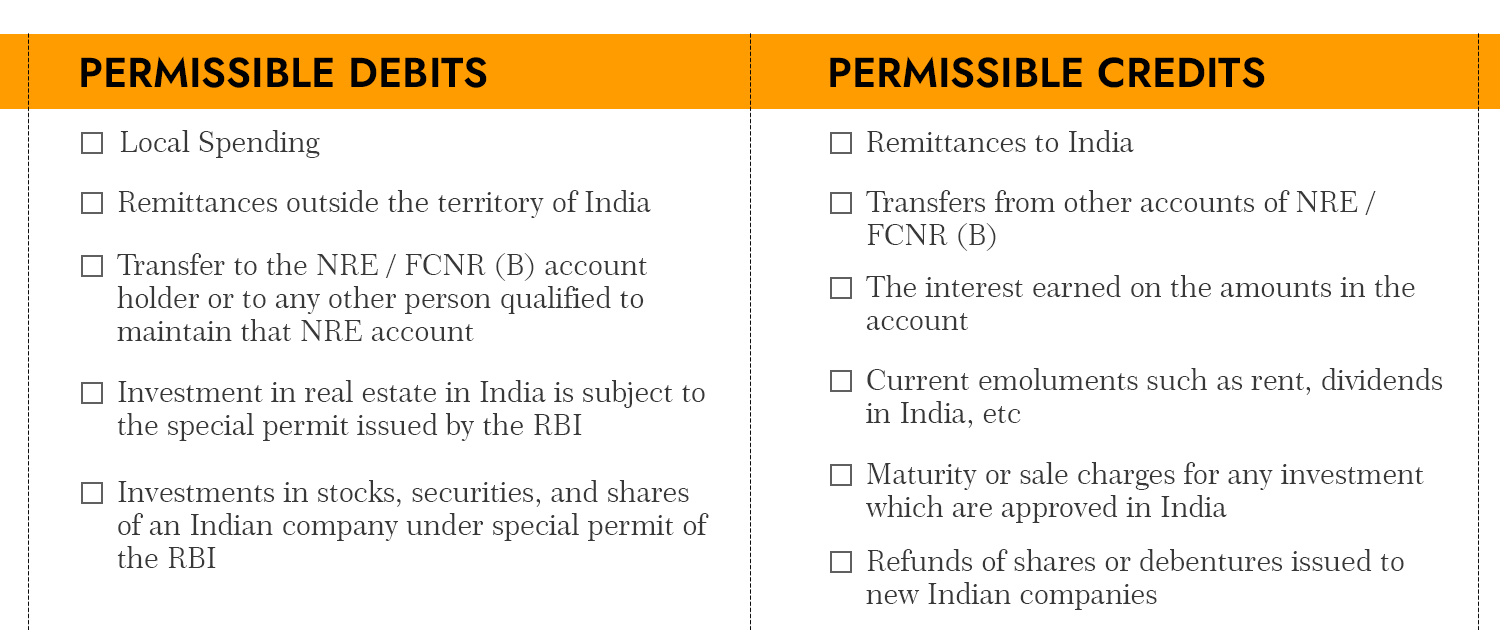

Deposits in NRE accounts must be income outside of India. NRIs cannot deposit their domestic money into these accounts. Also, one can use his account anywhere in the world using net banking services. In addition, banks offer international debit cards so that the account holder can trade and withdraw money. These accounts facilitate investment in India.

These accounts are manifested in the exchange rate fluctuations. This is because an NRI invests in foreign currency and returns the Indian rupee. There is therefore an opportunity for the NRI or Indian seafarers to withdraw more or less the initial deposit amount.

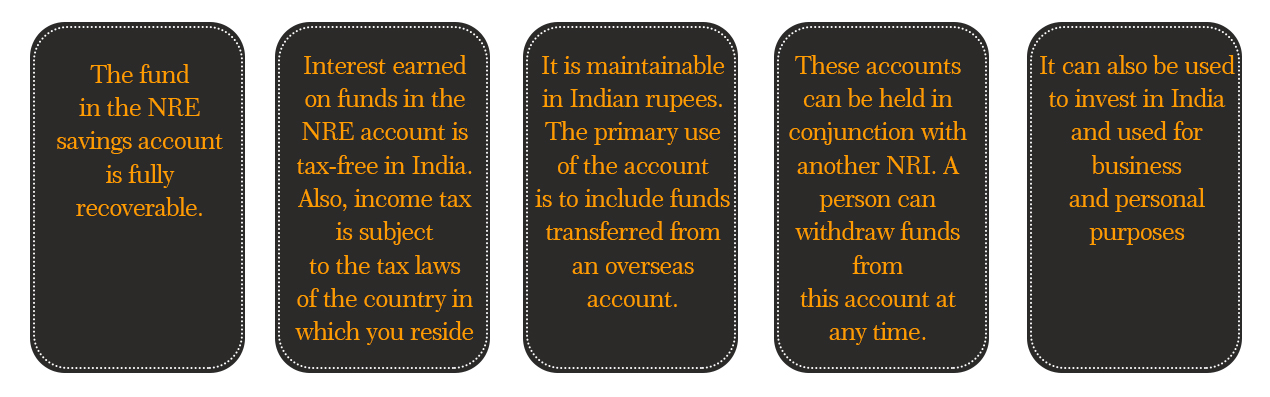

Characteristics of NRE account

Who are qualified to open an NRE bank account?

- The individual must be a non-resident Indian (NRI).

- An Indian citizen living abroad for education, job or business.

- Persons referred to UN agencies or officially deployed abroad by the Government of India or a public sector employee.

- Indian nationals who are seafarers or crew members of foreign airlines.

- Native Indian or overseas citizen of India.

- Indian passport holders at some point in time.

- The parent or grandparent was a citizen of India under the Indian Constitution or Indian Citizenship Act 1955.

- Indian citizen spouse or PIO spouse.

Types of #NRE Accounts

Some benefits of NRE account for Indian Seafarers

Let us have a look at the advantages to have an NRE bank account-

NRE account on becoming resident again

If the NRI comes to India for a short visit, it can continue with the account as an NRE savings account. However, if the NRI returns to India permanently, it is not allowed to maintain an NRE savings account. They are required to convert this account into a resident rupee account. If the NRI seeks to withhold foreign currency, it may be able to convert it into a Resident Foreign Currency (RFC) Currency Account.

Final words

NRE (Non- Residential External) is rupee savings account to transfer the foreign income of a non-resident (or Indian seafarers) to India. Interest earned on this account usually is not payable of tax under section 10 (4) (ii), so no TDS is held by the bank. However, it depends on your current resident status under FEMA. This account is very liquid, and all deposits are returned in full to the residence where NRI resides. In addition, the interest rate from these accounts is completely tax-free in India.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.