The MCA (Ministry of Corporate Affairs) has amended LLP Rules by introducing form 24 which paves way to easily dissolve the LLP by making an application to strike down the name. Section 63 of Limited Liability of Partnership Act, 2008 outlines on winding procedures of LLP. The mentioned winding up/ dissolution could either be voluntary or by Tribunal. The closure of such business can be initiated when there exists no business for the period of one year or more. In above mentioned scenario the dormant LLP can make an application to the ROC for declaring the company as defunct and request for removing the name of the LLP from the register of LLP’s. Here in this article, we will try to understand process to close LLP in India

Methods to close/wind up LLP in India

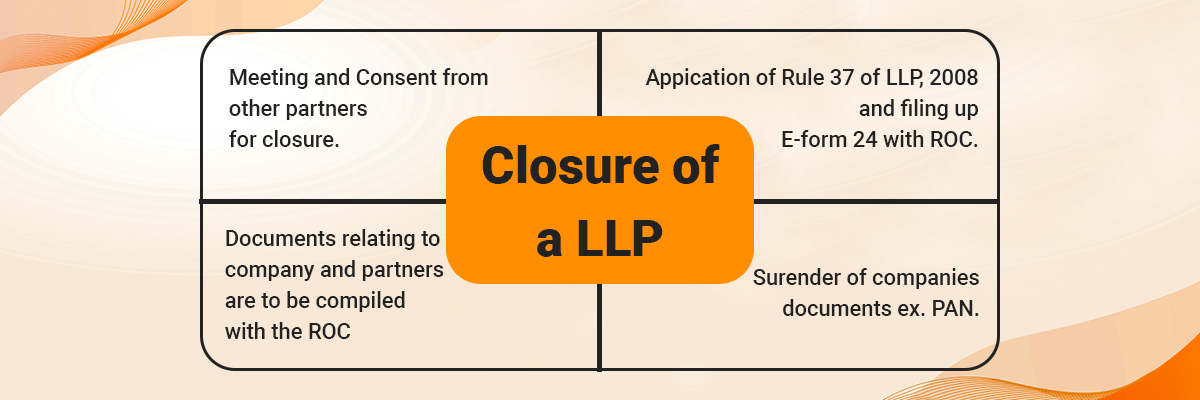

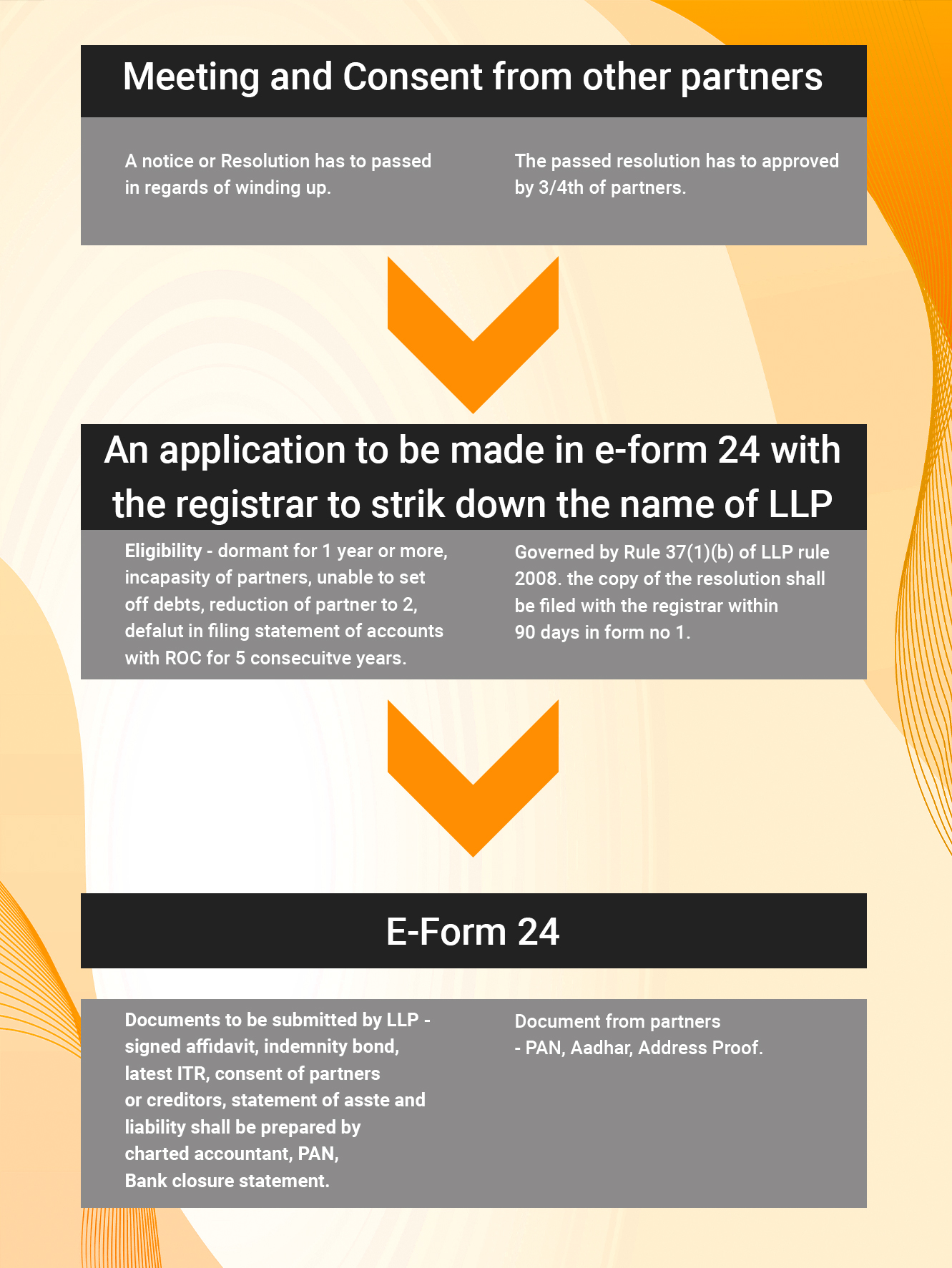

Process to close LLP in India

Unlike winding up of company the closure of LLP is not the legal end. It is pertinent to note that the partners have to file Indemnity form and undertakings, settling off all debts and paying off LLP’s liabilities further, with no objection raised from either by the partners or public a form has to file in with the ROC for proceeding with the closure. The Registrar after scrutinising will close down the LLP. In case of any discrepancy arises due to liabilities the partners will be held personally liable.

Thus, it is advisable to set off liabilities and retain a no-objection certificate from creditors as well the partners to cease oneself from liabilities that might raise in future.

Process/Flow Chart of closing LLP in India

Before filing LLP E-Form 24

- Closing Bank Accounts

- Dormant status

- Legal Declaration

- Filing up Form 8 and 11 on overdue returns

- Certification from Charted Accountant

- Form 24

- Penalty and other miscellaneous

- Closing Bank Accounts – Before filing for closure any bank accounts with regards to LLP must be closed and a letter of evidence must be produced to the Registrar.

- Dormant Status – LLP has to cease its function for a year or more in-order to proclaim its latent status for closure.

- Legal Declaration – An affidavit has to be sworn either jointly or severally denoting the inability or caesurae of business and other activities relating to promotion of the same. Notwithstanding that the LLP has to indemnify the liabilities and its status to be undertaken and submitted to the ROC while submitting the Form 24.

Further, the income tax return of the LLP and LLP deed must be enclosed (applicable only for an active LLP).

Note – Mere submission of the form will be entitled to the settlement of liabilities made the partner will be held liable for any liabilities that might emerge later.

Filing up Form 8 and 11

- Form 8 – Account and Solvency – should be filed within 30 days before the expiry of 6 months from the closure of financial year.

- Form 11 – Annual Returns – has to be filed within 60 days from closure of financial year.

Note – It’s a mandatory procedure to file the form irrespective to the LLP turnovers.

Requirements for filing

- LLPIN (Limited Liability Partnership Identification Number)’

- Declaration on the contributions made by the partners

- Fees payment (form 4 if applicable – form 4 deals with appointment, cessation, change of designation.)

Penalty for not filing Form 11 – Penalty of INR 100 per day will be chargeable till the date of filing.

Certification by Charted Accountant – after preparing and scrutinising all the documents that are prepared for filing a certified charted accountant has to certify nil asset and nil liability status not earlier to 30 days prior to closure of such LLP.

Filing LLP form 24 – form 24 can be accessible from MCA portal and filed up for striking down the name of LLP. The application has to be filled in with the details such as –

- LLPIN

- Name of LLP

- Address of registered LLP

- Reason for making this application – in 200 words

- Updating and status of ITR

- Copy of authority to make the application duly signed by all partners

- Copy of acknowledgment of ;attest income tax return

- Nil statement of account

- Signed affidavit by designated partners.

Penalty and Miscellaneous

The penalty for default in payment is INR 100 per day. For winding up a dormant LLP there’s no requirement to file form 11 and 8.

Conclusion

Form 24 is filled by LLP with the registrar; the submission has to wait for the approval of the registrar. After verifying all documents and if the registrar feels satisfied he shall send the name of the LLP to gazette to raise a public objection and with no objection received the registrar will strike off the name.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (117)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Understanding the provisions of GST Audit and Adjudication April 20, 2024

- April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines April 18, 2024

- Managing Director & Whole Time Director in a Private Limited Company April 17, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.