SOP for revocation of cancelled registration under Section 30 of GST Act in Rajasthan

- June 1, 2021

- Startup/ Registration

If you are registered under GST, you must know that it is not permanent, and the registration granted can be cancelled for stipulated reasons. The department can initiate the cancellation on their own motion (they cancel it), or you can also apply for cancellation of your registration. Due to some conditions as prescribed, any person whose registration is cancelled by the proper officer can apply to such an officer to revoke the registration.

Here comes the question for which you are here, how? How can you apply for Revocation (Revocation is the withdrawal or cancellation of something), i.e., How can you stop the cancellation of your registration?

Before moving forward, let’s try to understand the meaning and consequences of Cancellation of GST Registration.

Meaning of cancellation of GST registration

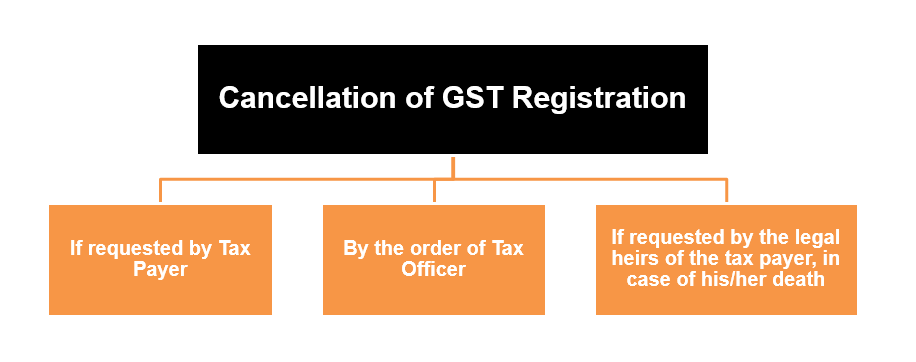

Cancellation of GST registration simply means that the taxpayer will not be a GST registered person any more. He will not have to pay or collect GST or claim input tax credit and accordingly, need not file GST returns. Cancellation of GST Registration can be done by:

Consequences of GST registration cancellation

- The taxpayer will not pay GST anymore

- For certain businesses, registration under GST is mandatory. If the GST registration is cancelled and business is still continued, it will mean an offence under GST and heavy penalties will apply.

Withdrawal of cancellation of GST Registration

- A taxpayer whose registration has been cancelled by the proper officer can apply for withdrawal of such cancellation of GST registration by using Form GST REG-21. This Form should be filed within 30 days from the receipt of notice for cancellation of GST registration.

- If, in your case, the registration has been cancelled due to non-filing of returns, a reversal application can be filed only when pending returns are filed along with interest and penalty.

- Also, such thirty days period may be extended, on sufficient reasons being shown. The grounds are to be recorded in writing by the Additional Commissioner (AC) or the Joint Commissioner (JC) as the case may be, for a period not exceeding thirty days; or by the Commissioner for a further period not exceeding thirty days.

Procedure to stop GST registration from cancellation

Following is the Step by Step procedure on how you can stop your registration from being cancelled, i.e., Revocation of cancellation in Rajasthan: –

Step 1: Log in to the GST portal and go to the ‘Services’ tab > followed by ‘Registration’ > there you will see ‘Application for revocation of cancelled registration.’ click here.

In case you are confused as to where you should go to Log in to your GST portal, you can access your portal at https://services.gst.gov.in/services/login, log in with your Username and Password.

Step 2: Insert the requisite information and reasons for the withdrawal of the cancellation of GST registration. Supporting documents (if any) can be attached here.

Step 3: After updating the details, go to the verification column. Select the authorized signatory and place from where the signatory is signing the Form.

Step 4: Now you can submit this application through EVC, i.e., electronic verification code, or sign through Digital signature.

Step 5: As soon you submit the Form, a message will be shown on the screen that the application is successfully submitted, an acknowledgment will be received in 15minutes. Your task ends here. Now the concerned officer will verify the application filed in Form GST REG-21 as above.

If the officer is not satisfied with the revocation application:

- In case, the officer is not satisfied with the revocation application, He will send you an SCN, i.e., a show-cause notice in Form GST REG-23, mentioning the reasons that why the revocation application needs to be rejected.

- He will ask you (the taxpayer) why the revocation application furnished by you should not be rejected.

- A chance is given to you to provide reasons why he should not cancel your GST registration.

- Now the assessee, i.e., you have to reply in Form GST REG-24 within seven working days from the due date of the issue of notice, i.e., date of issue of SCN. A question that might have arisen in your mind what is GST REG -24? Let us talk about it –

Form REG-24 comprises of the below information-

- Reference number and date of the notice, i.e., SCN;

- Reference number and date of application as filed by you;

- 15 digits GSTIN, i.e., Goods and Services Taxpayer Identification Number, like if you are from Rajasthan, your GSTIN will start from 08 followed by 13 more digits and alphabets.

- Reasons as given by the taxpayer for demanding Revocation are recorded.

- Documents that are required to be attached.

The tax officer will verify the reply received in Form GST REG-24. If the reply is satisfactory, he will issue the order for Revocation of GST registration in Form GST REG-22 within 30 days from the date of receiving a response in form GST REG-24.

If he finds the reply unsatisfactory, he can reject the application by issuing an order in Form GST REG-05.

On the contrary, if the concerned officer is satisfied with the revocation application, he will record the reason in writing. He will also issue the order for Revocation of GST registration in Form GST REG-22 within 30 days from getting a reply in form GST REG-21.

Key Takeaways

There is no need to worry if you have received a notice regarding the cancellation of your registration; follow the above steps, and you are there, all set to communicate with the department. Also, the application of Revocation cannot be rejected unless a reasonable opportunity of being heard is given to the applicant. Remember that Revocation cannot be applied when GST registration was cancelled intentionally and voluntarily by a taxpayer himself/herself.

For more information, related to revocation of GST Registration, contact our team of experts at Legal Window or simply drop an email at admin@legalwindow.in

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Cryptocurrency startups and Regulatory compliance April 22, 2024

- Understanding the provisions of GST Audit and Adjudication April 20, 2024

- April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines April 18, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.