Working capital is an accounting phrase that you may not hear much about, but it could be the key to your company’s success. Working capital has an impact on many elements of an organization, including paying staff and vendors, keeping the lights on, and planning for long-term growth. In a nutshell, working capital is the cash on hand to cover immediate, short-term obligations. When a business is sold, an adjustment to the purchase price may be required to make up any difference between the available working capital at the time of closing and the working capital required to keep the firm running on a day-to-day basis. A working capital adjustment is a popular term for such a change. Here in this blog Legal Window guides you through the Role of Working Capital Adjustments in Transfer Pricing.

| Table of Contents |

What do you understand by Transfer Pricing?

The value ascribed to the commodities or services moved between related parties is known as Transfer Pricing. To put it another way, transfer pricing is the price paid for goods or services that are transferred from one unit of an organization to other units in different nations (with exceptions). The value connected to transfers of goods, services, and technology between related businesses, as well as value attached to transfers between unrelated parties with common ownership or control, is referred to as “transfer pricing.” The Income Tax Act of 1961 in India codifies the legislation on transfer pricing.

Income from ‘foreign transactions’ between ‘related firms’ must be calculated using the ‘arm’s-length pricing’ approach, according to India. In addition, any expense or interest allowance resulting from an international transaction must be calculated using the arm’s-length price. Further, in this blog we will guide you about Working Capital Adjustment in Transfer Pricing.

Why Transfer Pricing is Important?

- A subsidiary of a firm may be separated into segments or accounted for as a separate entity at times. In these situations, transfer pricing aids in the proper allocation of revenue and expenses to such subsidiaries.

- Multinational corporations (MNCs) have some latitude in determining how to distribute revenues and expenses to subsidiaries in various countries for the purposes of management accounting and reporting.

- The pricing at which inter-company transactions take place determine a subsidiary’s profitability. When transfer pricing is used, it can have an impact on shareholders’ wealth since it affects the company’s taxable income and after-tax free cash flow.

- It is critical for a firm that conducts cross-border intercompany transactions to grasp the transfer pricing concept, particularly in order to meet legal compliance requirements and avoid the risk of non-compliance.

Transfer Pricing and the Arm’s Length Price

Transfer prices are judged correct under the arm’s length criterion if they fall within a variety of prices that would be realized by individual parties dealing at arm’s length with products, services, or intangibles. However, because no parties involved or transactions are the same, applying an arm’s length norm to transfer pricing is problematic. Goods, sales terms, economic conditions, and company profiles are always distinctive to the circumstances.

To obtain appropriate prices, modifications must be made to the arm’s length standards.

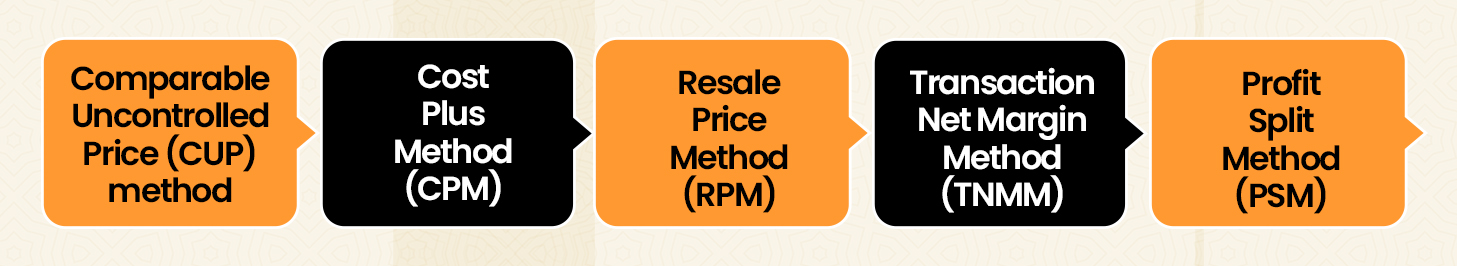

The arm’s length price can be calculated using the following:

When you are required to do Capital Adjustments?

Adjustments to working capital should only be made if the outcomes are known to be more dependable afterward. They should only be used for differences that have a significant impact on the comparison. If any modifications to primary comparability variables are required, it shows that the third party is not sufficiently comparable.

When using the transactional net margin approach, capital adjustments can be necessary. They’re most commonly detected when using a transactional net margin approach, although they could also be found using cost-plus or resale price methods. These adjustments should only be undertaken when the comparables’ reliability has improved and changes can be performed with reasonable accuracy. They shouldn’t be made automatically, and tax authorities wouldn’t accept them automatically either.

Calculation of Working Capital Adjustments according to the OECD rules

Step 1- Determine the variances in working capital levels. Normally, trade receivables, inventory, and trade payables are used to calculate working capital adjustments because financial statements provide information on these items. The TNM method is used in conjunction with a suitable basis, such as cost, sales, or assets. If cost is the starting point, any changes in working capital should be quantified in relation to cost.

Step 2: Use an acceptable interest rate to calculate a value for variances in working capital levels between the tested and similar parties, relative to an appropriate base and indicate the time value of money.

Step 3: Adjust the results to account for variations in working capital.

Issues Relating to Transfer Pricing

- There may be disagreements among organizational divisional managers over how the transfer price should be determined.

- Managers of organizational units may engage in dysfunctional behaviour as a result of arm’s length pricing.

- Executing the transfer prices and building the accounting system to meet the criteria of transfer pricing standards would take more time, money, and labour.

- In a multinational setting, the transfer price issue is quite complicated.

- Arm’s length prices don’t work as well for other divisions or departments, such as a service department, because such departments don’t provide measurable advantages.

Conclusion

The goal of the working capital adjustment is to make comparables more reliable. It is obvious that income tax provisions, as well as the OECD, allow for working capital adjustments to erase any discrepancies in working capital structure between the tested party and comparables. As a result, we must investigate the possibilities of adjusting working capital as needed to improve the quality of comparables by eliminating differences in working capital structure. Legal Window will provide you with expert services in order to deal with any of your queries. Feel free to contact us on our E-portal or contac

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (116)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.