MSME stands for Micro, Small and Medium Enterprises. MSME has an important role in the growth of Indian economy as Indian economy is majorly dependent on agriculture and small businesses. MSME is the backbone of the Indian economy, hence it is extremely endorsed by the government. For MSME Registration, the government of India provides various subsidies, schemes & incentives to MSMEs to promote it through MSME Act. MSMED Act furnish measures for promotion, development, growth, and improvement of competitiveness of MSME and establishment of National board for MSME Registration.

MSME Act was formed on October 02, 2006 to provide various benefits, incentives, schemes, and subsidies granted by the government to the micro, small and medium enterprises. MSME entrepreneurs need to register themselves under MSME Act, 2006 with the concerned department. MSME registration is also important for developing responsibility and clarity in the micro, small, and medium enterprises.

An Overview of MSME Sector

The Micro, Small, and Medium Enterprise abbreviated as MSME is the backbone of a progressive country like India. The central objective to establish the MSME sector was to empower the development of micro, small, and medium enterprises. It majorly contributes to the manufacturing, employment, exports, and industrial units.

To undertake any business operations, an entrepreneur must have enough funds. Considering the inadequacy of capital in startups, the Government enables collateral-free credit. It ensures to provide the fund requirement of micro and small sector enterprises. Such an initiative is a boon for both the old and new enterprises. Moreover, the Government has introduced a trust namely ‘The Credit Guarantee Trust Fund Scheme’ and SIDBI(Small Industries Development Bank Of India) to further guarantee the implementation of Credit Guarantee Scheme for all SSI’s.

One can get multiple other benefits like a hassle-free opening of bank accounts, the grant of bank loans at lower interest rates, discarding stamp duty and registration charges, etc.

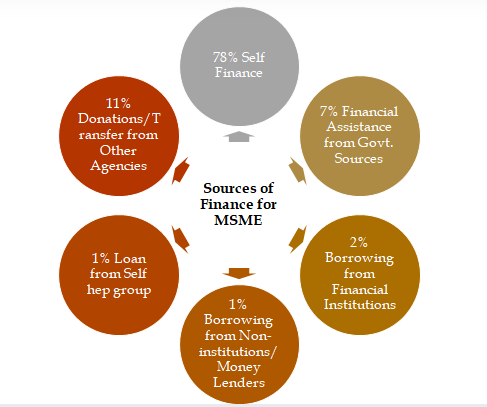

Sources of Finance for MSME’s

Source: ICSI

Advantages of MSME Registration

Registration of Micro, Small and Medium (MSM) Enterprises under MSMED Act provides various benefits and incentives offered by the Central Government which includes the following:

- Easy finance availability from Banks, without collateral requirement

- Multiple Tax Rebates

- Preference in obtaining Government tenders

- Benefits in Stamp duty and Octroi

- Exemption under Direct Tax Laws.

- Financial help for setting up testing facilities through NSIC

- Subsidy on ISO Certifications

- Subsidy on NSIC Performance and Credit ratings

- Participation in Government Purchase registrations

- Registration with NSIC

- Concession in electricity bills

- Reservation policies relating to manufacturing / production sector enterprises

- Reimbursement of expenses for taking ISO Certification

- Excise Exemption Scheme

Classification of Micro, Medium and Small Enterprises

According to the MSME Act, 2006, MSMEs have been broadly classified in two categories:

- Manufacturing Enterprises: Such Enterprises are involved in Manufacturing activities

- Service Enterprises: Such Enterprises are involved in providing services to other industries.

Eligibility for MSME Registration

Recently, under Aatmanirbhar Bharat Abhiyaan, the government has revised the MSME Classification and the difference between manufacturing and services enterprises has been eliminated. They can be defined in terms of investment and annual turnover in Plant and Machinery/ Equipment as below:

- MICRO ENTERPRISES

These are the smallest entities and investment allowed for manufacturing enterprise and service enterprise is less than 1 crore and annual turnover of less than Rs. 5 crore.

- SMALL ENTERPRISE

Under these category of enterprises, Investment allowed is between 1 crore and 10 crore with annual turnover ranging between Rs. 5 crore to Rs. 50 crore

- MEDIUM ENTERPRISE

Medium enterprise allows investment in between 10 crores to 20 crores and annual turnover ranging between between 50 crores to 100 crores.

| Type of MSME | Micro | Small | Medium |

| Manufacturing Enterprises and Service Enterprises, both | Investment Amount – Less than Rs. 1 crore Annual Turnover – Less than Rs. 5 crore | Investment Amount – Rs. 1crore to Rs. 10 crore Annual Turnover – Rs. 5 crore to 50 crore | Investment Amount – Rs. 10 crore to Rs. 20 crore Annual Turnover – Rs. 50 crore to Rs. 100 crore |

Facilities to MSME’s

There are numerous facilities which are provided to MSME’s under State and Central Government. They are as follows:

- Facilities under Central Government

- Easy Sanction of bank Loans (Priority Sector)

- Lower Rates of Interest

- Excise Exemption Scheme

- Exemption under Tax Laws

- Statutory Support such as reservation and Zero Interest on delayed payments.

- Facilities under State Government

- Specialized Departments for MSME

- Development of specialized industrial estate

- Tax Subsidies

- Power Tariff Subsidies

- Capital Investment Subsidies

Checklist

Before applying for MSME Registration, you must have a proper registered undertaking. Registration will be processed further only if your enterprise falls in any of the following categories:

- Sole Proprietor,or

- Association or a group of persons, or

- Co-operative Society, or

- Hindu Undivided Family, or

- Partnership Firm, or

- One-person company, or

- Limited liability partnership, or

- Private limited company, or

- Producer Company

- Or any other undertaking

Documents required for MSME Registration

Following important documents are required for MSME Registration:

- Basic Details/Documents

- Aadhar Number

- PAN

- Account Number with IFSC Code

- NIC Code

- List of number of employees

- Expected date of commencement of business

- Other Documents:

- Address proof of the business

- Copy of Industrial License

- Bills and receipts on purchase of machinery

- Sales and Purchases Bill

- Documents in case of Unregistered and Registered Partnership Firm

- Unregistered Partnership Firm – Partnership Deed

- Registered Partnership Firm – Registration Certificate

- Documents in case of company/LLP

The following documents are required in case of a company- Memorandum of Association (MOA) of Company

- Articles of Association (AOA) of Company

- Certificate of Incorporation of Company/LLP

- A copy of the resolution passed in general meeting of the company

- A copy of board resolution authorizing a director to sign the application of MSME .

Process of MSME Registration in India

The procedure of MSME registration is quite simple and an online process which can be done in few minutes. Follow the step by step process of MSME Registration:

- Step-1: The first step in the process of MSME registration is to file a MSME form online by visiting the online platform of Udyog Aadhar Memorandum and keep your Aadhar card handy as it is mandatory.

- Step 2: On visiting the portal, enter the 12 digit Aadhar Number and fill in the name of the entrepreneur.

- Step 3: Now click on “Validate and Generate OTP” and enter the OTP received

- Step 4: Once the verification through OTP is completed, you need to fill the details relating to business such as company name, email id of company, registration number, PAN details, GST number, Bank Account Number, NIC code, Annual turnover of business and so on.

- Step 5: Now after filling in all the necessary details, click on submit button to generate OTP which will be send to the email address which you have provided. Further, an OTP will be provided for the second time on your registered mobile number after which click on “Final Submit”

- Step 6: An acknowledgement number will now be sent to registered email address and mobile number.

- Step 7: Once the verification of your application and documents is done, you will receive UAM number for your business

- Step 8: Finally, you reach onto the last step in which you will receive the MSME registration number and you can download the MSME registration certificate from the Udyog Aadhar portal.

MSME schemes launched by the Government

- Udyog Aadhar Memorandum

- Zero Defect Zero Effect

- Grievance Monitoring System

- Incubation

- Quality Management Standards and Quality Technology Tools

- Women Entrepreneurship

- Credit Linked Capital Subsidy Scheme

Takeaway

MSME continues to be one of the most important sector of India and after the recent introduction of Aatmanirbhar Bharat Abhiyan, it availed many more benefits by getting a huge share of pie in Indian budget. We at Legal window believes that when MSME grows, then the economy of the country also grows simultaneously.

Contact Legal Window for more information and get in touch with our experts for MSME Registration.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (116)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.