The due date for filing Income Tax Return is approaching. There are lots of things that cross your mind when you sit with your Form-16 to file the return. There are 7 ITR Forms notified by Income Tax Department. In this article we will discuss ITR-1 and ITR-2 Forms. Normally salaried class person has to file one out of these forms, if they do not have business income. Let us discuss these forms in this article.

| Table of Contents |

Who should file the Income Tax Return?

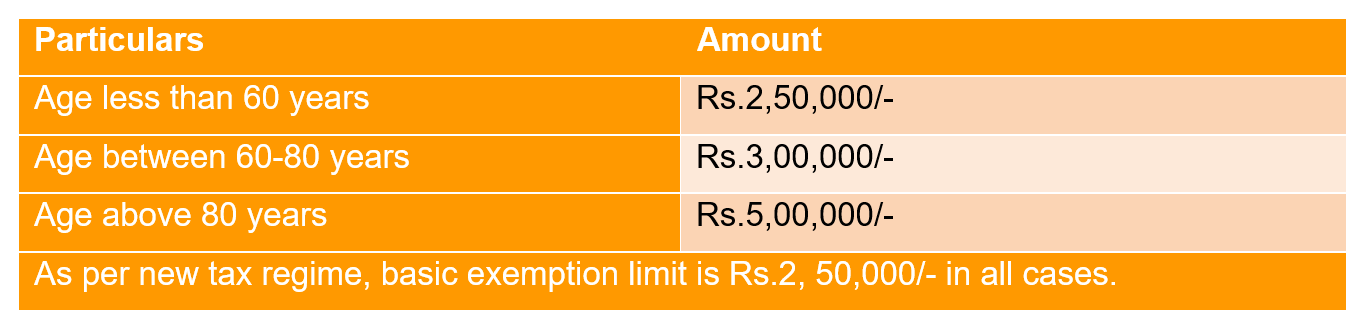

As per Income Tax Law, any person whose income exceeds the following basic exemption limit should file a return.

Also following people are required to pay return compulsorily

- People having deposits of amount exceeding Rs.1 crore or more in a current account.

- Anyone who wants to claim a tax refund.

- Person who wants to carry forward or set-off losses should file return irrespective of income/loss.

- Person who needs to produce returns as an income proof for loans etc.

- People having income from foreign assets.

Now we will discuss about all Income Tax Return (ITR) Forms for AY 2021-2022.

What is Form-ITR-1 (SAHAJ) and who can file it?

ITR-1 form (SAHAJ) is simplest Income Tax Return form. This form is to be filed by Resident Individuals. Income Tax Department has divided these forms on the basis of source of income and category of taxpayer. In this case also there are guidelines as to that who can file their return of income under ITR-1.

Applicability of ITR-1

- This form can be used by a resident individual.

- The income of the person should be less than Rs.50 lakhs.

- The source of income should be salary, house property or income from other sources.

- A person for whom, income from any of above sources is clubbed for spouse/minor.

- Has agriculture income up to Rs.5000/-

Who cannot file ITR-1?

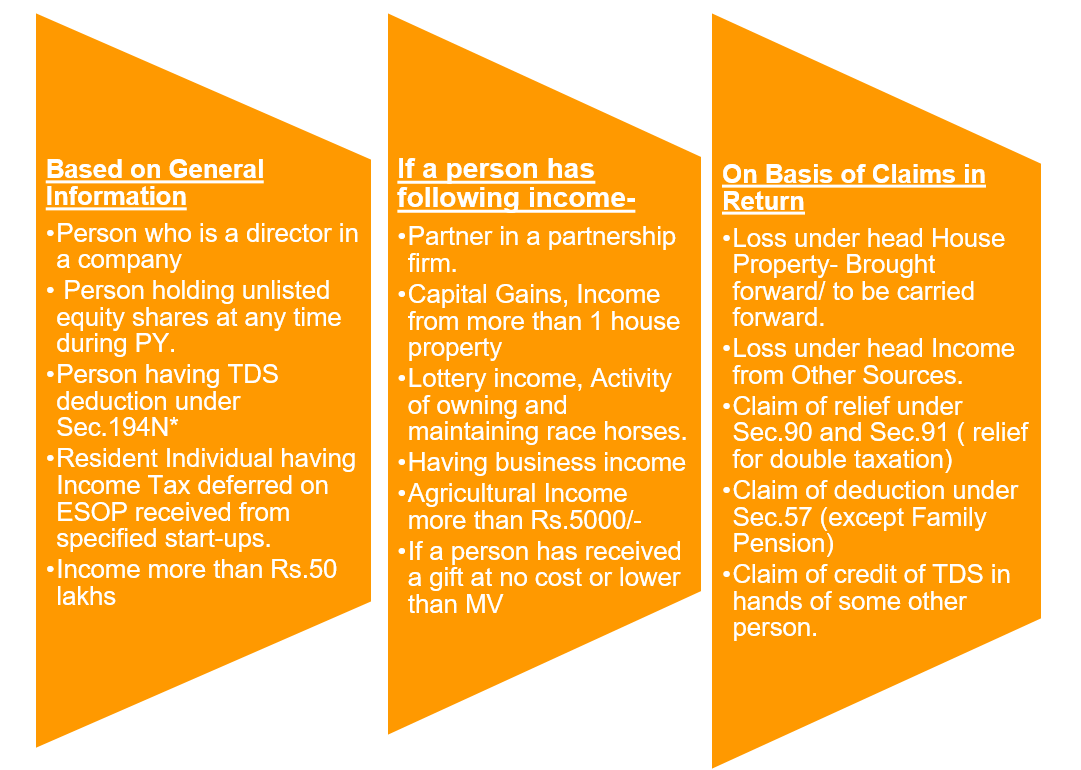

The persons falling under below conditions cannot file ITR-1. These conditions can be categorized into three broad categories:

*Sec-194N- TDS deducted by Bank etc. where cash withdrawals exceed specified limit under section

What is Form ITR-2 and its applicability?

ITR-2 form is applicable on Individual/HUF. The form can be filled by person who does not have business income. The following persons are eligible to file ITR-2

- The person having an income of more than Rs.50 lakhs.

- The source of Income can be- Salary, House property (even if more than 1 house property), Income from other Sources, Capital Gains

- The person who is a Director in a company.

- Where a person wants to claim set-off and carry forward of losses.

- Resident but not ordinarily resident (RNOR) or Non-Resident

- Person owning unlisted equity shares, Deferred Tax on ESOP.

- Having agricultural income more than Rs.5000/-

In short we can say, that people not eligible to file ITR-1 can file ITR-2, except for those having Business Income.

Some Recent Modifications

- Resident Individuals above 75 years of age have been exempted from return filing if their source income only contains-pension and interest income.

- Income Tax Department has also launched its new e-filing portal which is more user friendly and offers guidance at each step. It is having simple Q&A mechanism or pop-up explanations in case you have doubt regarding some important fields.

- Option to avail option u/s 115BAC (New Tax Regime) is provided in the return form, it can be claimed only till the due date under Sec 139(1)-Original Return.

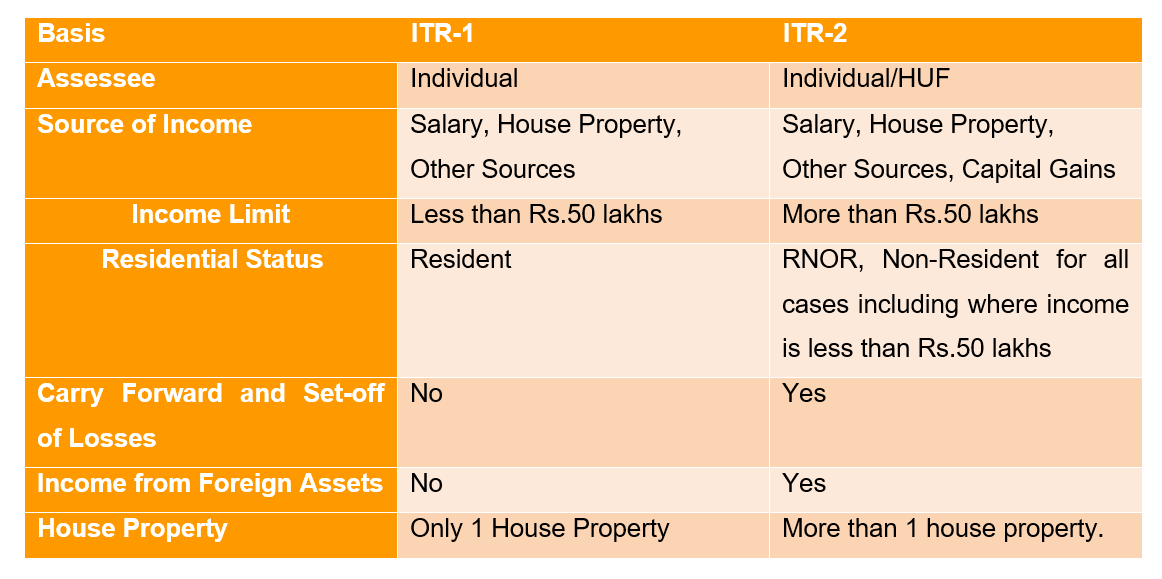

ITR-1 and ITR-2 – Comparing the two

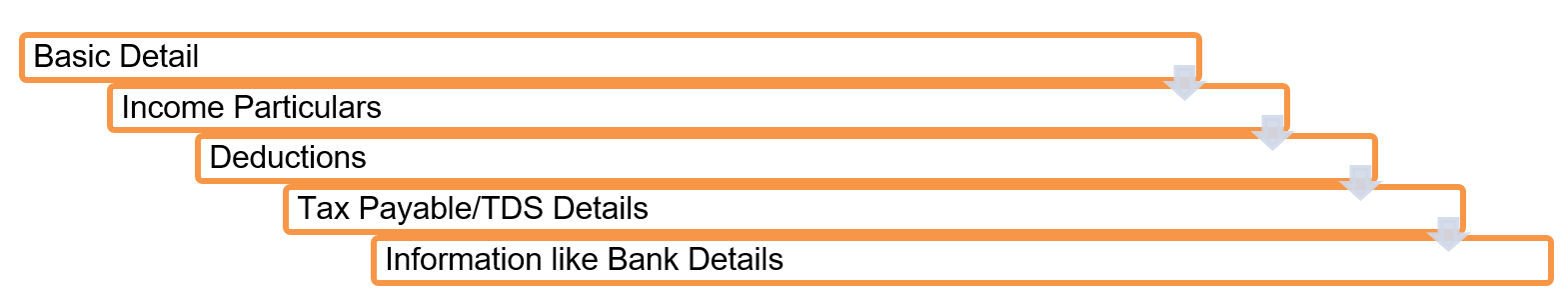

The parts of both the forms are also different; the basis for that difference is the nature of income reported and deduction claimed. However the basic premise remains same. i.e.

We will discuss basic schedules of ITR-1 and ITR-2 forms briefly now.

Understanding Forms ITR-1 and ITR-2 Applicable for AY 2021-22

| Basis | ITR-1 | ITR-2 |

| General Information | Basic details like name, address, DOB, type of employer, option to avail new and old tax regime | |

| Gross Total Income | Income Details under all heads of income. | Income under all heads of income. Details of Foreign Source Income, Exempt Income, Tax Relief u/s 90,90A and 91 |

| Deductions | Deductions to be claimed under chapter VI-A. Details for medical insurance and donations | Deduction to be claimed under chapter VI-A. Deduction for medical insurance, donations, donation for scientific research or rural development. |

| Taxable total income | Computation of Total income

|

|

| Computation of Tax Payable

|

Details of tax payable, Details of Advance Tax, Self-Assessment Tax and TDS deducted | |

| Other Schedules |

|

|

| Other Information | Bank Account for refund of tax | |

| Verification and Submission | Verification using EVC, Aadhaar OTP | |

Final Words

This was the discussion about ITR-1 and ITR-2 forms for AY-2021-22. The above discussion will definitely be helpful for you while selecting the applicable form and filling details therein. The details to the extent available on TRACES website in regards to Form-16 and TDS deductions are already pre-filled. The other details should be entered in the return form step by step. Lastly the return needs to be verified preferably with an EVC or a Aadhaar OTP. Filing of Income Tax Return is a simple process however, in case of any doubt please get in touch with our team for easy and hassle-free assistance.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.