Residential status is a very important concept as per Income Tax Act. The very decision that what will be the income on which tax is to be paid by a person depends on the residential status. The act lays down several criteria for different individuals as to what will be the stay period on which the status of a person for a particular year will be decided. So let’s see in detail that what the concept of Residential Status under Income Tax is

| Table of Contents |

Concept of Residential Status

Residential status is one of the pillars on which taxation stands. Residential status needs to be determined for all persons.

- The residential status in case of an Individual or HUF can be resident ordinarily resident/ resident not ordinarily resident/non-resident.

- The residential status in case of company or a firm can only be either resident or non-resident.

- Tax incidence on certain income is dependent on the residential status of the person.

- Staying in India is not only staying in geographical boundaries of India but it also includes being in the limit of territorial waters of India.

- The date of arrival and date of departure are both counted as stay in India.

- A person shall be deemed to be of Indian origin if he, or either of his parents or any of his grand-parents, was born in undivided India.

Now, let us see that how the residential status is determined as per IT Act.

Determination of Residential Status

Section-6 of the Income Tax Act contains the criteria as to who is to be treated as a resident ordinarily resident / resident not ordinarily resident/ non-resident.

1. In case of Individuals/HUF

As per Sec.6 the resident is someone, satisfying any of the below basic conditions

- Stayed in India for 182 days or more during the previous year, or,

- Whose stay during 4 preceding previous years is 365 days or more and is 60 days or more in the relevant financial year.

Exceptions to the above rule are: –

| In case of an Indian Citizen/Person of Indian Origin who has left country for employment or as a crew member the period of 60 days will be substituted with 182 days. | In case of an Indian Citizen/Person of Indian Origin the period of 60 days will be taken as 120 days, if total income of the person excluding the income from foreign sources exceeds Rs.15 lakhs. |

- In case of an Indian Citizen/Person of Indian Origin who has left country for employment or as a crew member the period of 60 days will be substituted with 182 days.

- In case of an Indian Citizen/Person of Indian Origin the period of 60 days will be taken as 120 days, if total income of the person excluding the income from foreign sources exceeds Rs.15 lakhs.

Now, once a person qualifies as a resident it needs to verified if he is a ROR/RNOR

Further ROR (Resident Ordinarily Resident) will be a person who

- Was a resident in 2 years out of past 10 immediately previous years. and

- Has stayed in India for at least 730 days in 7 immediately preceding years.

RNOR (Resident not ordinarily Resident) will be the person who satisfies any 1 of the above secondary conditions.

Non- Resident will be the person who does not satisfy any of the above conditions.

2. In case of Company

- An Indian Company will always be treated as a resident

- A Non-Indian Company will be treated as resident if its place of control is wholly India, otherwise it will be treated as non-resident

3. In case of Firm/every other person

- If the place of control is wholly or partly in India then it will be treated as a resident.

- If the place of control is wholly outside India then it will be a non-resident person in India.

Now, there have been few amendments to the above rule as per recent Finance Act. Let us discuss those amendments.

Amendments in Finance Act,2020

Recently Finance Act, 2020 has brought some changes to the above rules.

- As per Finance Act, 2020 in case of an Indian Citizen or Person of Indian Origin the period of 60 days above will be substituted with 120 days if total income of the person excluding the income from foreign sources exceeds Rs.15 lakhs.

- Also in case of an Indian Citizen whose total income (excluding foreign sources) exceeds Rs.15 lakhs and he is not liable to pay tax in any other country then such person will be deemed resident in India.

Foreign sources means income that has accrued or arise outside India. However, income from a business controlled in India or a profession set up in India will be included.

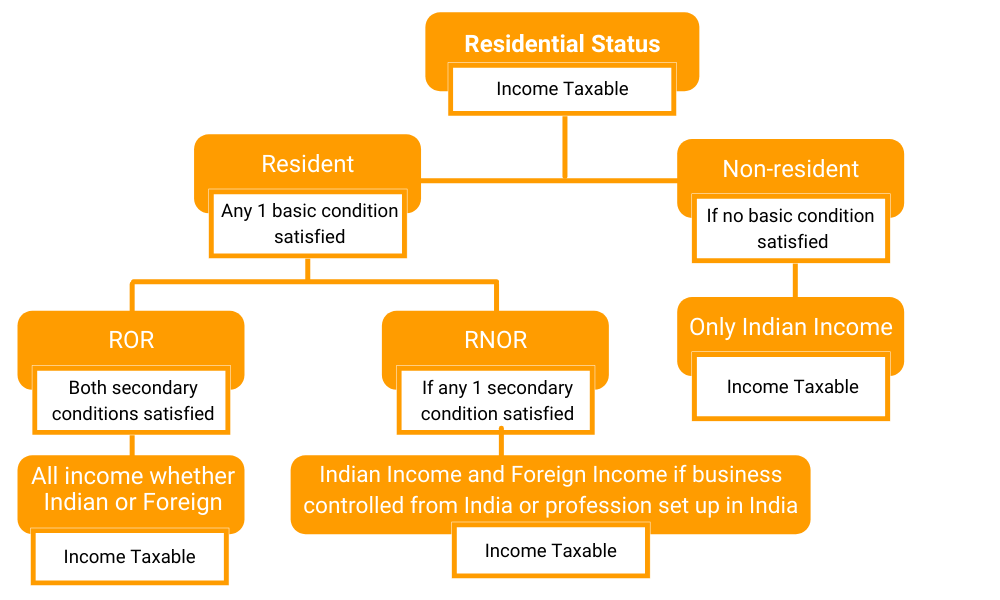

Implication of Residential Status

On the basis of above discussion we understood that a person can be ROR/RNOR/Non-Resident. Now, these status decide that what income will be taxable in India for these persons. Let us understand the same in brief.

Conclusion

As per above discussion, we can say that residential status as per Income Tax is the basic ingredient for taxing any person in India. A person can be staying anywhere in India. The recent amendments have rendered the Indian Citizens/Person of Indian Origin as residents if they stay in a previous year for more than 120 days (instead of 60 days) in second basic condition. Also in case of Indian Citizen for whom there is no tax liability in any other country they will be treated as residents for tax purpose in India. Determination of residential status is important so as to arrive at total income of a taxpayer correctly. So, if you stay in and out of the country on a random basis, keep your travel history handy before filing the return.

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost. Our team offers expertise solutions in various fields that include Corporate Laws, Direct Taxations, GST Matters, IP Registrations and other Legal Affairs.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.