There is one question which always crept in mind of the business owner whether the company can give loan to its director. Is there any penalty involved? We will get the answer to this question in Section 185 of the Companies Act, 2013 which is one of the most important sections of the Act.

Introduction of Section 185 of the Companies Act, 2013

Earlier, companies through inter-corporate loans used to borrow funds and give it to their subsidiaries and associate companies. In this procedure, holding companies never complied with the loan agreement terms concerning the exploitation of borrowed funds. On the other hand, banks also never bothered to monitor such events or exploitation in the corporate world. To control such activities, Section 185 of the Companies Act, 2013 was introduced to lay down certain restrictions on inter-corporate loans on companies. Further, it put some restrictions on companies in giving loans to its directors, so that the working of the directors can be well monitored.

In this article, we will put stress on one question “ whether the company can give loan to its directors”

Concept of “Loan to Directors by Company” as per Section 185 of Companies Act, 2013

A Company which may be:

- Private Company

- Public Company

- One Person Company

- Small Company

- Start ups, etc.

Are not allowed to advance any loan or any guarantee, directly or indirectly, including any loan represented by a Book Debt, to :

- Any of its directors, or

- Any director of its holding company, or

- Any partner or relative of such director

- Firm in which any such director is a partner

- Firm in which the relative of any such director is a partner

Hence, the provisions of Section 185 clearly states that companies cannot give loan to its director or any of its relatives. Further, loan is also not provided to any other such person, in which the director is interested.

Meaning of “Any other Person in whom the director is interested”

As per Section 185 of the Companies Act, 2013, the meaning of “any other person in whom the director is interested” means:

- Any company in which the said director or any of his relative is a Partner or Director

- Any Private Company in which the said director or any of his relative is a director

- A Body Corporate in which the director holds or controls 25% or more of voting powers.

- Any Body Corporate who’s Manager/Managing Director/Board of Directors acts on his directions and instructions.

Exemptions regarding Loans given to Directors

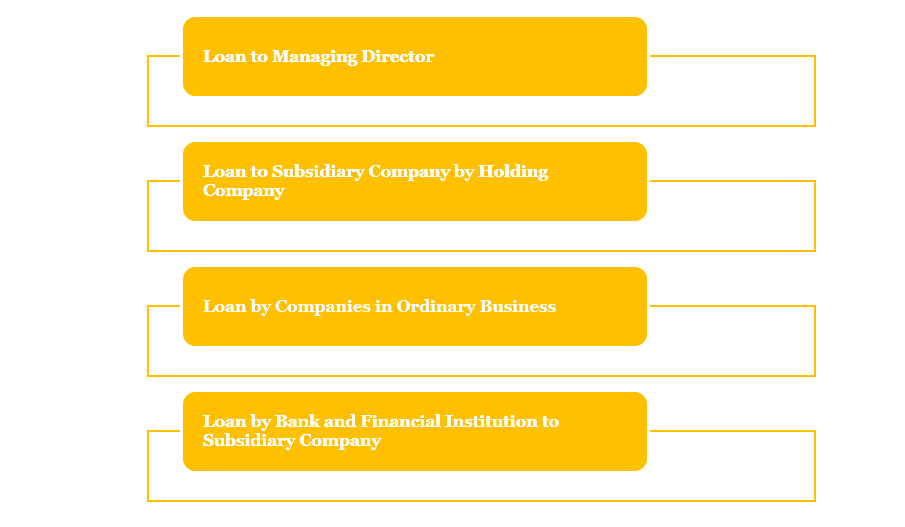

As a reader, you might have understood that a company cannot provide loans to its directors. However, there are certain exemptions under Section 185 of the Companies Act itself, where the company can give loans to certain class or categories:

- Loan to Managing Director or Whole Time Director

Loan can be provided to Managing Director of the Company if:- Approved by a special resolution in a properly convened meeting

- A Policy is made available to all the employees of the company as a part of their policy of Service Loan to Managing Director or Whole Time Director

- Loan by Holding Company to its Subsidiary Company

Holding Company is allowed to provide loan to its wholly owned subsidiary company if the wholly subsidiary company uses the provided loan only for its principal business activity and not for any other purpose.

Note: Principal business activity includes the main object of the company for which it is formed. - Loan by Companies in Ordinary Business

A Company in the course of ordinary business may provide loan, security or any other guarantee, at a rate of interest which is not less than the prevailing rate as notified by the Reserve Bank of India in this regard. - Loan by Banks and Financial Institutions to Subsidiaries

A Holding Company can provides any guarantee or security in respect of any loan made by any bank or financial institution to its subsidiary company. However,the subsidiary company can utilize the said loan only for its principal business activity.

Penal Consequences for violation of Section 185 of the Companies Act, 2013

In case the rules and regulations of Section 185 of the Companies Act, 2013 are not followed, then the following penal consequences will occur on:

- Lending Company:

Fine not less than Rs. 5 lakh which may extend to Rs. 25 lakhs. - Defaulting Officer:

- Imprisonment for a term extending up to 6 months, or

- Fine not less than Rs. 5 lakh which may extend to Rs. 25 lakhs

- Recipient Director:

- Imprisonment for a term extending up to 6 months, or

- Fine not less than Rs. 5 lakh which may extend to Rs. 25 lakhs

Or with both

Conclusion

Introduction of Section 185 of the Companies Act, 2013 marks the complete prohibition on companies providing any loan to its director or any other person or entity related to such director. However, later on it was observed that such changes must be made for better governance and transparency in the corporate world along with better management of the affairs of the company. Such changes, in fact, help in keeping the eye on the working of the directors of the company. On the other hand, Section 185 allows loans to directors with more better safeguards in addition to more responsibility on officers and company

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (117)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Understanding the provisions of GST Audit and Adjudication April 20, 2024

- April, 2024 Tax Compliance Tracker: Income Tax & GST Deadlines April 18, 2024

- Managing Director & Whole Time Director in a Private Limited Company April 17, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.