Appointment of KMP in a Company : Section 203 of the Companies Act, 2013

- September 17, 2021

- Compliance

The Companies Act,2013 has introduced the concept of KMP (Key Managerial Personnel). This concept is basically for bringing all the heads into one main head as they all are part of the company. As the board of directors set goals and objective of the company. But KMPS play important role in the day-to-day activity of the company and helps in achieving the goal of the company.

| Table of contents |

Section 2(51) of the Companies Act,2013 provides the legal definition of “Key Managerial Personnel”.

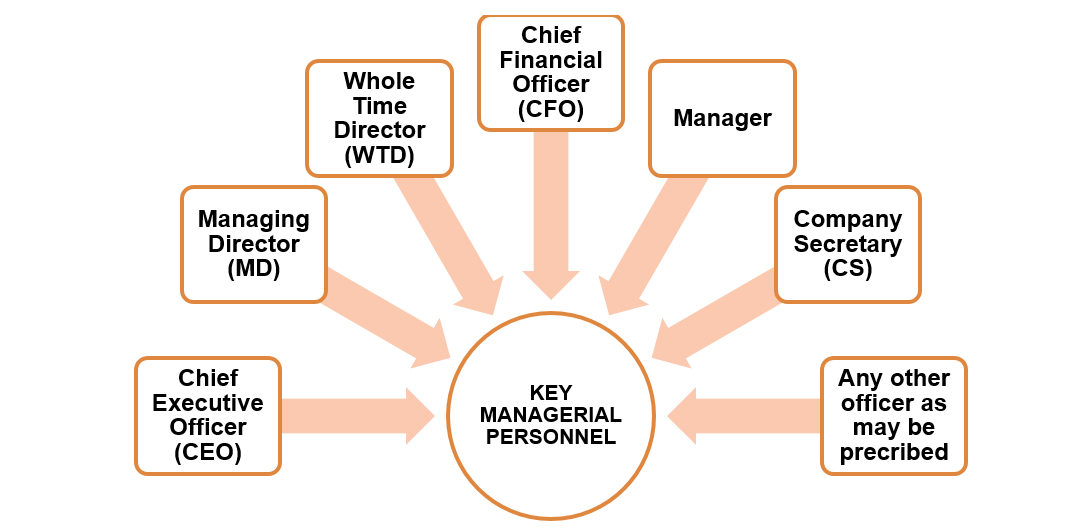

Who is a Key Mangerial Personnel?

Key Managerial Personnel means

- The chief Executive Officer, Managing Director, or Manager.

- Company Secretary.

- Whole Time Director.

- Chief Financial Officer.

- Such other officer, not more than one level below the director who is whole-time employment, designated as KMP by the board, and

- Such other officer as prescribed.

Requirement for Appointment of KMPs

Section 203 of Companies Act,2013 read with rule 8 of the Companies Rules, 2014 (Appointment and Remuneration of Managerial Personnel), the following class of the company shall appoint KMP:

- Every Listed Company

- Public Company, Paid-Up Capital 10 crore or more

Further, rule 8A of Companies Rules,2014 states that any company whose paid-up capital is 5 crore or more can appoint a whole-time company secretary.

KMP can be the director of any other company

KMP will obtain permission from the board for being the director of any other company. Permission will be granted by the board in the board meeting. And if permission is given then it will be informed to all the directors of the company. If the board does not grant the permission then he cannot be the director of any other company.

Vacancy in KMP

If the office of any KMP is vacant then, it shall be filled up within 6 months from the date of such vacancy.

Penalty for infringement

If a company breaches the provision of section 203, then the company has to pay a penalty of 5 lakh rupees.

If the director or KMPs breaches the provision, then they have to pay a penalty of rupees 50,000. And if it continues then 1000 per day till it continues.

The Procedure of Appointment of KMP

- KMPs are appointed under section 203 of the Companies Act,2013. Every member should be appointed through the resolution adopted by the board. Including the terms and conditions of appointment and remuneration.

- A member of managerial personnel can hold the position in one company at a given time. A member can be the member of managerial personnel of its subsidiary company.

- If there is a vacancy it is to be filled within 6 months of such vacancy.

- If the company violates the provision of appointment of managerial personnel, the company has to suffer a penalty. Fine will be of 1 lakh rupees which may extend upto 5 lakh rupees.

Maintenance of Register

The company which will be falling under the provision of Key Managerial Personnel is required to maintain a register. The register contains particulars of the directors and KMPs and is to be placed at the registered office of the company. The document includes information on securities held by them in the company or its holding, subsidiary of a holding company or associate company. And other contents mentioned in Rule 17 of Companies ( Appointment and Qualification of Directors )Rule,2014.

Roles and Responsibility of KMP

- The KMPs will be liable for non-compliance of the provisions provided under the Companies Act,2013.

- The management functions and the decisions of the company are the responsibility of the KMPs.

- As per section 170,detailed information of securities will be provided by KMPs and recorded in the register of the company.

- In the audit committee, the right to heard will be provided to KMPs while considering the audit report. But they don’t have the right to vote.

- AS per section 189(2), KMPs will disclose all their concerns and interest within 30 days of their appointment.

Disqualifications for being KMP

Section 196(3) of the Companies Act,2013 states that a company shall not appoint or continue the employment of a managing director, whole-time director, or manager if such person:

- Not completed age of 21years or exceeds the age of 69 years.

- Is an uncharged insolvent or adjudged as an insolvent.

- Record of holding payments from creditors.

- Convicted by the court for an offence and imprisonment for more than 6 months.

- Not appointed for more than 5 years at a time.

- Detained under the contravention of Foreign Exchange and Prevention of Smuggling Activity Act,1974.

Conclusion

The KMP plays a very important role in the company. As they work for the day to day operation of the company so, that the objective of the company is achived. The ministry of corporate affairs and security exchange made the compulsory appointment of the KMP in the company. And provide the particular law for the appointment of KMP in companies Act,2013. So, that company can operate in the spirit of the law.

CS Urvashi Jain is an associate member of the Institute of Company Secretaries of India. Her expertise, inter-alia, is in regulatory approvals, licenses, registrations for any organization set up in India. She posse’s good exposure to compliance management system, legal due diligence, drafting and vetting of various legal agreements. She has good command in drafting manuals, blogs, guides, interpretations and providing opinions on the different core areas of companies act, intellectual properties and taxation.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (147)

- Compliance (88)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (116)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.