In recent past we have shifted from money in the wallet to money in the digital wallet. Demonetization lead this drive of digital wallet and Covid-19 took the things forward. In the same manner, there is one more thing that is slowly paving the path and it set to become a new sensation in the financial world is Cryptocurrency. In this read we will discuss all about crypto currency and its taxability.

|

Table of Content |

What is Cryptocurrency ?

Crypto means encrypted key and Currency as we all know is a source to purchase and sale of goods or services.

Crypto currency is therefore a Digital or Virtual currency encrypted by cryptography. It is very volatile and highly portable. Crypto currency is used synonymously with Bitcoin, but they are not same. Bitcoin is one among many other cryptocurrencies in the market. There are specific exchanges for trading cryptocurrency.

Mostly cryptocurrency works on the concept of blockchain technology. It is still decentralized system . Therefore, it is outside the control of governments and central authorities.

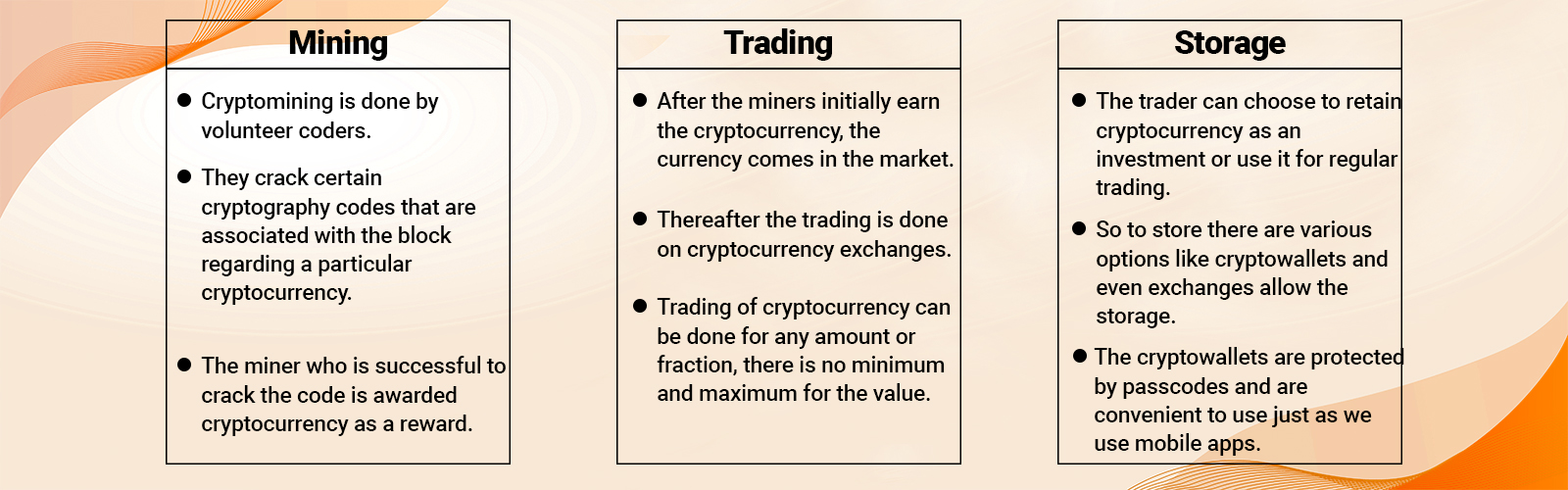

Modes to get Cryptocurrency

As mentioned above, cryptocurrency works on the concept of blockchain. Blockchain is a distributed ledger that is enforced by a disparate network of computers. In simple term, blockchain records all the transactions. There is no involvement of any third party.

Following chart shows that how cryptocurrency actually works-

Is Cryptocurrency Legal in India?

The legality of cryptocurrency in India has always been a matter of confusion in India. In the year 2018, RBI issued a circular where it instructed all the financial institutions to stop providing services to business dealing in cryptocurrencies.

After that a writ petition was filed in Supreme Court of India. Supreme Court of India ruled that the circular by RBI is not at all valid. As RBI has no power to prohibit the activity of trading in virtual currencies.

As cryptocurrency is not a legal tender in India, it does not form part of even the credit system of India. So, RBI cannot regulate it as it regulates the currency in India.

From above discussion we can say that although trading in cryptocurrency is legal in India but cryptocurrency is not a legal tender in itself. That is we cannot do sale/purchase using cryptocurrency in India unlike many western countries.

Do I need to pay tax on income from trading in Cryptocurrency?

Can we say that if there is no law than the income is tax-free, well it is a BIG NO. Income Tax is chargeable even on illegal incomes.

Government of India is currently working on bringing the cryptocurrency trading under taxation. As cryptocurrency trading generates income, the same should be taxable. As per news columns recently, RBI officials have also agreed with government’s stand. We can apply basic concepts of Income Tax have to understand the Cryptocurrencies Taxes in India. Therefore, let us discuss the same.

Cryptocurrencies Taxes in India

To discuss the taxation of Cryptocurrencies first of all we have to see that how a user gets crypto currency in the first place.

As discussed above, one can get it either by Mining or Trading. Now, we will discuss the probable methods for taxation.

Business income

The trader of may treat the trading of cryptocurrency as business.

- If he treats is as Business Income, then the income will be taxable under the PGBP.

- This means that trader can claim business expenses from income and resulting profits will be taxable at the applicable tax rates.

- Going by this the audit provisions will also apply if any business crosses threshold limit.

- There may be case where cryptocurrency is received as a consideration against any business transaction. In such cases also the amount will be a part of turnover.

Capital Gains

There can be two scenarios in this case-

- Mining- In case of Mining, the asset is self-generated. Now, as per provisions of Income Tax Act, only few self-generated assets are listed in the act. Only for those assets the cost of acquisition will be “Nil”. Also, as per judgment in case BC Srinivasa Shetty the cost of acquisition of all other assets will be not determinable. So, in case of Mining income cannot be taxed under this head.

- Selling after purchasing through Trade- In this case the cost of acquisition will be the actual purchase price. The sale value will be actual sale value. The difference between both will be taxable value. You thought you found a solution, wait there are some issues here also-

- Whether to take indexation benefit or not?

- Will these treated like shares and securities or other capital assets?

- How to determine Long Term or Short Term Capital Gain?

- In case of loss, what will be the treatment of loss?

So, after above discussion Capital Gains does not seem to be a wayout for Cryptocurrency Taxes in India. Let us explore further:-

Income from other sources

The income can also be treated as income from other sources if it is neither investment nor business. In this case normal rates as applicable to the assesse will be applicable.

- The income earned by selling cryptocurrency that was earned through mining can also be taxed.

- Sale of cryptocurrency after purchase can be taxed here also. If a person is facing issues as mentioned above in Capital Gains.

- There may be case where cryptocurrency is received as a consideration for any transaction. If not covered under business, the same will be taxable here.

Conclusion

As per current income tax laws, there are no proper provisions for Cryptocurrency taxes in India. In the above discussion we have tried to analyse the possible ways to tax Cryptocurrency transactions in India. This discussion is on the basis of present provisions of the law. As per recent news, Government of India is keen on bringing the laws for Cryptocurrency Taxes in India. We will discuss this topic again once Government of India brings some changes and announces the rules for Cryptocurrency Taxes in India.

CA Pulkit Goyal, is a fellow member of the Institute of Chartered Accountants of India (ICAI) having 10 years of experience in the profession of Chartered Accountancy and thorough understanding of the corporate as well as non-corporate entities taxation system. His core area of practice is foreign company taxation which has given him an edge in analytical thinking & executing assignments with a unique perspective. He has worked as a consultant with professionally managed corporates. He has experience of writing in different areas and keep at pace with the latest changes and analyze the different implications of various provisions of the act.

Categories

- Agreement Drafting (23)

- Annual Compliance (11)

- Change in Business (36)

- Company Law (148)

- Compliance (89)

- Digital Banking (3)

- Drug License (3)

- FEMA (17)

- Finance Company (42)

- Foreign Taxation (6)

- FSSAI License/Registration (14)

- GST (118)

- Hallmark Registration (1)

- Income Tax (199)

- Latest News (34)

- Miscellaneous (164)

- NBFC Registration (8)

- NGO (14)

- SEBI Registration (6)

- Section 8 Company (7)

- Start and manage a business (20)

- Startup/ Registration (126)

- Trademark Registration/IPR (40)

Recent Posts

- Detailed Analysis of Section 179 of the Companies Act, 2013 April 24, 2024

- Maximise Your Tax Savings: Power of Form 12BB April 23, 2024

- Cryptocurrency startups and Regulatory compliance April 22, 2024

About us

LegalWindow.in is a professional technology driven platform of multidisciplined experts like CA/CS/Lawyers spanning with an aim to provide concrete solution to individuals, start-ups and other business organisation by maximising their growth at an affordable cost.